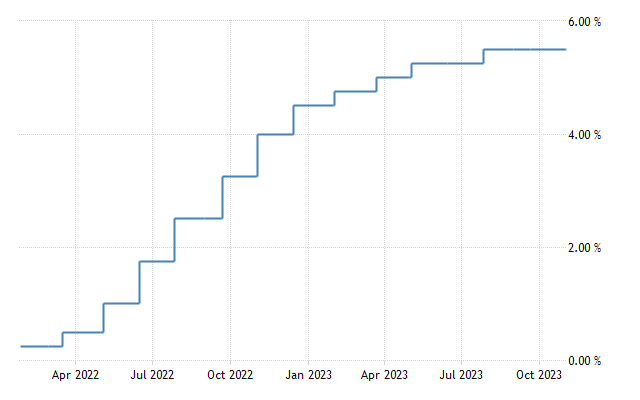

Not even the FED knows how long they are going to keep interests at their current levels. They missed the inflation ramp up during the pandemic. And now they are playing catch up.

The FED has 2 mandates: Jobs and Inflation. Keeping jobs up and inflation down. Right now the inflation comes first. They need people to lose their jobs in order for inflation to continue dropping. The FED has stated that they want inflation to be around 2%. Right now, inflation is moving in the right direction. It has dropped from its highs during the pandemic. But it seems like it will be a long time before it reaches that 2% level.

Are the current rates good or bad?

For me they are good.

The current interest rates makes bonds and savings account more attractive than they have ever been in recent memory. I would argue unless you live in Japan interest rates close to zero are not normal and probably not good in the long run. Bonds are now a solid alternative to stocks.

And I do love me some stocks. I will always love stocks and be a stock investor.

Normally rising interest rates hurt stocks. And stocks have not done great the last 6 months. But for the most part stocks are doing well because the economy is still strong. Businesses are focused on cost cutting and being profitable and it appears to be working. I’m still all in on stocks.

But right now I have also been aggressively adding to my emergency savings account. My bank is currently paying an interest rate of 5%, which is way more than I have ever been able to get.

People can also buy U.S. Treasuries. Prior to the Pandemic U.S. Treasuries paid very little, which is good for the U.S. When interest rates are low the U.S. can issue more bonds, because they are less expensive to service. Now to that rates have risen the U.S. is having to pay a lot more in interest to service newly issued bonds.

But this means that U.S. citizens can lock in rates near 5% for years or even decades to come. This is a good thing for aging Boomers that might need cash flow.

What about housing?

I hear you. These rates are bad for housing. It is expensive to get a new mortgage. And a lot of people locked in low rates during the pandemic and now will not be interested in moving to a new home. Which means that there will be low inventory for longer and bidding wars for high quality homes.

If you are wanting to buy a home go ahead and buy it. These rates will not last forever and eventually they will start to drop allowing new homeowners to refinance.

For me, I am staying put in my home and working on home improvement projects. Making my home look as good as possible.

My prediction

These rates are going to last for several years. They are not going away anytime soon. Even when inflation really starts to drop and go away, the FED will continue to keep the interest rates where they are to make sure that inflation does not creep back into the money supply.

The FED takes a long term view and is willing to wait for economic cycle to change.

Take advantage of this time to get the most out of your savings account. To purchase US bonds or bank CDs that are paying aggressive rates. Even though these rates will last longer than anyone expected they will not last forever and eventually the FED will drop rates again, which will reduce the amount you make on your bank savings.

Leave a comment