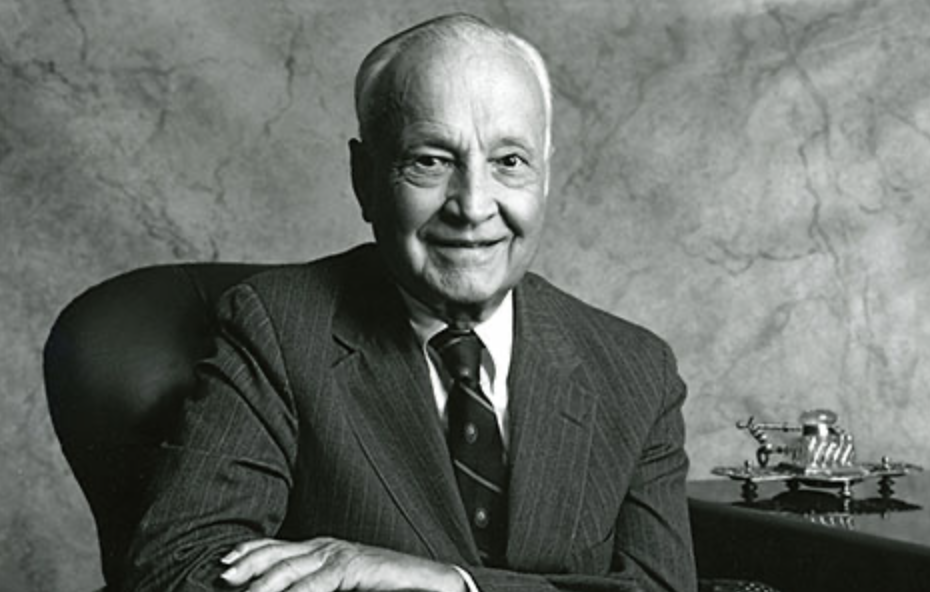

Sir John Templeton was a British-American investor, philanthropist, and mutual fund pioneer known for his contrarian investment approach and his lifelong commitment to seeking value across global markets. He is widely regarded as one of the greatest investors of the 20th century. Here is some background information on John Templeton:

Early Life and Education:

John Marks Templeton was born on November 29, 1912, in Winchester, Tennessee, USA. He displayed an early interest in business and finance, which led him to study economics at Yale University. He later earned a master’s degree in law from Oxford University as a Rhodes Scholar.

Start of Investment Career:

Templeton’s investment career began in 1937 when he borrowed money to invest in 104 companies trading for less than $1 per share on the New York Stock Exchange. His contrarian approach, seeking value in undervalued stocks, laid the foundation for his investment philosophy.

Contrarian Investing Approach:

Templeton was known for his contrarian approach to investing, often buying stocks that were out of favor or trading at depressed prices. He famously said, “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Global Perspective:

Templeton’s investment philosophy extended beyond U.S. markets. He believed in the value of international diversification and sought investment opportunities across different countries and regions.

Formation of Templeton Funds:

In 1954, John Templeton established the Templeton Growth Fund, which allowed investors to access his unique investment approach. The fund’s international focus and emphasis on value investing attracted investors and led to its success.

Early Focus on Mutual Funds:

John Templeton’s use of mutual funds to allow investors to participate in his investment strategies was ahead of its time. He recognized the potential for individual investors to pool their resources and benefit from professional money management.

Achievement of Extraordinary Returns:

Under Templeton’s leadership, the Templeton Growth Fund achieved extraordinary returns, consistently outperforming the market averages. His investments in companies across diverse sectors and geographic regions contributed to his success.

Philanthropy and Giving:

In 1972, Templeton established the John Templeton Foundation, which funds projects and initiatives related to science, spirituality, and human potential. He believed in the power of philanthropy to make positive contributions to society.

Knighted by the Queen:

In 1987, John Templeton was knighted by Queen Elizabeth II for his contributions to business and philanthropy.

Authorship and Legacy:

Templeton wrote several books, including “The Templeton Plan,” in which he shared his investment philosophy and insights. His legacy as an investor and philanthropist continues through the Templeton Funds and the work of the John Templeton Foundation.

Personal Life:

John Templeton was known for his humility, deep spiritual beliefs, and commitment to ethical values. He maintained a lifelong curiosity and openness to new ideas.

Passing Away:

Sir John Templeton passed away on July 8, 2008, leaving behind a legacy of financial success, philanthropy, and a unique investment philosophy that continues to inspire investors worldwide.

John Templeton’s pioneering investment approach, his global perspective, and his dedication to philanthropy have made him a legendary figure in both the investment and philanthropic communities. His ability to find value in diverse markets and his emphasis on discipline and long-term thinking continue to influence investors to this day.

Leave a comment