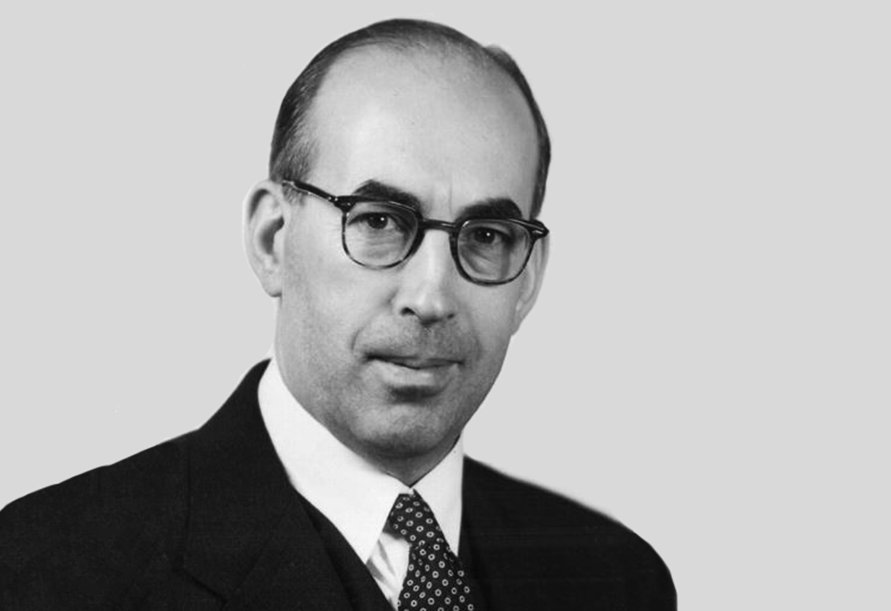

Philip Arthur Fisher, commonly known as Phil Fisher, was an American investor and author known for his pioneering work in growth investing and his influence on some of the most successful investors of his time. He is best known for his book “Common Stocks and Uncommon Profits,” which introduced innovative investment concepts that continue to shape modern investment strategies. Here is some background information on Philip Fisher:

Early Life and Education:

Philip Fisher was born on September 8, 1907, in San Francisco, California, USA. He attended Stanford University, where he studied economics. During his time at Stanford, he developed an interest in investment analysis and finance.

Investment Philosophy:

Fisher is recognized for his innovative investment philosophy, which emphasized a long-term approach to investing in high-quality growth companies with strong competitive advantages. He believed in conducting in-depth research to identify companies with exceptional growth potential.

Influence on Warren Buffett:

Fisher’s investment philosophy had a profound impact on Warren Buffett, one of the most successful investors in history. Buffett has often credited Fisher’s teachings and insights as a significant influence on his own investment approach, particularly his focus on long-term value and the quality of a company’s management.

Career and Contributions:

Fisher founded his own investment advisory firm, Fisher & Co., in 1931. He was an early proponent of conducting extensive company research, including talking to company management, suppliers, customers, and competitors. He emphasized the importance of understanding a company’s competitive position, growth prospects, and industry trends.

“Common Stocks and Uncommon Profits”:

Fisher’s most notable contribution to the investment world is his book “Common Stocks and Uncommon Profits,” published in 1958. The book introduced a range of investment concepts, including the “scuttlebutt” method of gathering information, the importance of management quality, and the significance of a company’s competitive advantages (moats).

Scuttlebutt Method:

Fisher’s scuttlebutt method involved gathering information about a company by talking to a wide range of people associated with the company. This approach aimed to provide insights into the company’s operations, competitive landscape, and growth potential.

Long-Term Perspective:

Fisher’s investment philosophy emphasized a patient and long-term approach to investing. He believed that successful investing required holding high-quality growth stocks over extended periods, allowing the company’s intrinsic value to appreciate.

Personal Life:

Phil Fisher was known for his humility and dedication to his work. He maintained a low profile and focused on his investment research and writing. He passed away on March 11, 2004, leaving behind a lasting legacy in the field of investment.

Legacy and Influence:

Fisher’s investment principles and teachings continue to influence investors and fund managers. His emphasis on qualitative research, understanding the business behind the stock, and investing for the long term remains relevant in today’s investment landscape.

Philip Fisher’s innovative ideas and commitment to in-depth research have left a lasting impact on the investment community. His work laid the foundation for growth investing and inspired generations of investors to focus on the quality and growth potential of the companies they invest in.

Leave a comment