Michael Burry is an American physician, investor, and hedge fund manager who gained significant recognition for his early prediction of the subprime mortgage crisis of 2007-2008. He is known for his contrarian investment strategies, his in-depth research, and his unique insights into the financial markets. Here is some background information on Michael Burry:

Early Life and Education:

Michael James Burry was born on June 19, 1971, in San Jose, California, USA. He displayed an early interest in investing and finance and pursued a degree in economics from the University of California, Los Angeles (UCLA). After completing his undergraduate studies, he attended Vanderbilt University School of Medicine and earned a medical degree.

Founding Scion Capital:

While in medical school, Burry began actively investing in the stock market. In 2000, he founded Scion Capital, a hedge fund that allowed him to apply his investment insights and strategies. He managed the fund while practicing medicine part-time.

Subprime Mortgage Crisis Prediction:

One of Michael Burry’s most significant achievements was his early recognition of the impending subprime mortgage crisis. In the mid-2000s, he conducted extensive research and identified the unsustainable nature of the housing market and the potential collapse of the mortgage-backed securities market. He bet against these securities using credit default swaps, a move that ultimately resulted in substantial profits for his fund.

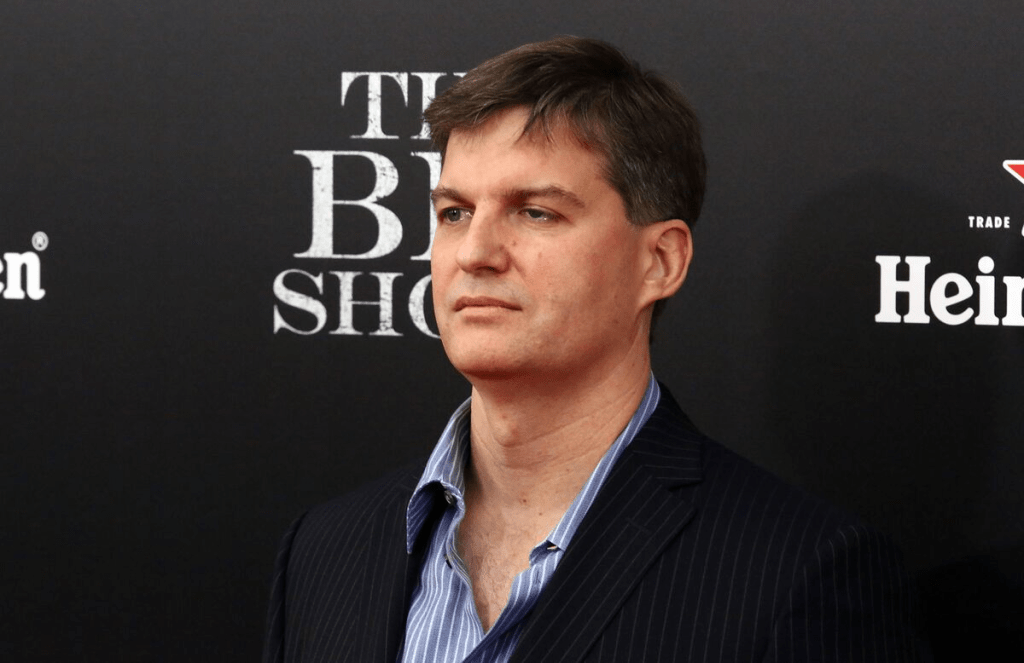

Portrayal in “The Big Short”:

Michael Burry’s story was featured in the book “The Big Short” by Michael Lewis, which chronicled the events leading up to the subprime mortgage crisis and the investors who profited from it. Burry was portrayed by Christian Bale in the film adaptation of the book.

Investment Approach:

Burry is known for his meticulous research and deep understanding of financial instruments. He often takes contrarian positions and focuses on uncovering undervalued or misunderstood assets. His investment decisions are informed by thorough analysis and a long-term perspective.

Post-Crisis Activities:

After successfully navigating the subprime mortgage crisis, Burry shifted his focus to other investment opportunities. He has made investments in various sectors, including water rights, agricultural land, and healthcare.

Media and Public Perception:

Burry’s early prediction of the subprime mortgage crisis and his success in profiting from it earned him both admiration and attention. He has been featured in financial media and has given interviews to share his insights on investing and the economy.

Investment Blog:

Burry maintained a blog on the investment website Value Investors Club, where he shared his research and analysis on various investment opportunities.

Personal Life:

Michael Burry is known for his low-key and private lifestyle. He has been vocal about his focus on investing rather than media attention and often distances himself from the limelight.

Michael Burry’s unique approach to investing, his deep analytical skills, and his ability to identify significant market trends have earned him a place among the notable investors of his time. His early prediction of the subprime mortgage crisis showcased his contrarian thinking and his dedication to rigorous research.

Leave a comment