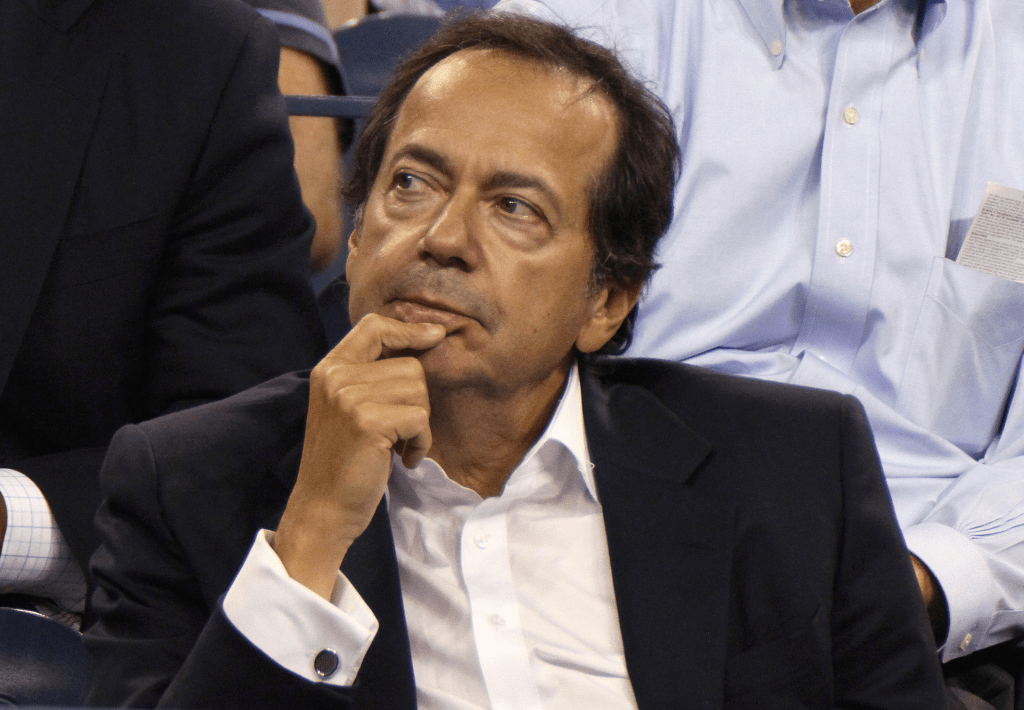

John Alfred Paulson is an American hedge fund manager and investor who gained significant recognition for his role in foreseeing and profiting from the subprime mortgage crisis of 2007-2008. He is the founder and president of Paulson & Co., a prominent hedge fund firm. Here is some background information on John Paulson:

Early Life and Education:

John Paulson was born on December 14, 1955, in Queens, New York City, USA. He displayed an early interest in finance and attended New York University’s College of Business and Public Administration, where he earned his Bachelor’s degree in Finance.

Founding Paulson & Co.:

In 1994, Paulson founded Paulson & Co., a hedge fund management firm headquartered in New York City. The firm gained attention for its investment strategies, including merger arbitrage, distressed debt, and event-driven investing.

Subprime Mortgage Crisis:

John Paulson’s most notable accomplishment came during the subprime mortgage crisis. In 2007, he foresaw the impending collapse of the housing market and the financial turmoil that would follow. He crafted investment strategies that allowed his fund to profit significantly from the crisis, earning him billions of dollars and solidifying his reputation as a shrewd investor.

Credit Default Swaps and Profits:

Paulson’s strategy involved purchasing credit default swaps (CDS) on mortgage-backed securities that he believed were overvalued. As the value of these securities declined due to the subprime mortgage crisis, the value of the CDS increased, leading to substantial profits for his fund.

Personal Wealth and Recognition:

Paulson’s successful bets against the housing market made him one of the highest-earning hedge fund managers in history. His impressive returns during the crisis garnered attention from both the financial industry and the media.

Philanthropy:

Paulson is also known for his philanthropic efforts. In 2010, he pledged $100 million to the Central Park Conservancy in New York City, which remains one of the largest donations to the park. He has also contributed to various educational institutions and medical research initiatives.

Investment Strategies:

Beyond his success during the subprime mortgage crisis, Paulson’s investment strategies have varied over the years. His firm has been involved in various areas, including distressed debt, merger arbitrage, and special situation investments.

Challenges and Performance:

While Paulson gained recognition for his success during the financial crisis, his subsequent performance has faced challenges. The performance of some of his funds has been mixed, and his firm’s assets under management have fluctuated.

Publicity and Media:

John Paulson has been featured in various media outlets and financial publications. He has participated in interviews, panel discussions, and conferences to share his insights on investing and the financial markets.

Personal Life:

John Paulson maintains a relatively private personal life. He is married and has two children.

John Paulson’s foresight in anticipating the subprime mortgage crisis and his subsequent success in profiting from it established him as a notable figure in the investment world. While his investment journey has included both triumphs and challenges, his impact on the financial industry remains significant, and his strategies and decisions continue to be of interest to investors and analysts.

Leave a comment